These courses cater to different skill levels, providing comprehensive insights into How to Become Self-Employed. This flexibility helps prevent burnout and promotes better mental and physical well-being, as you can create a schedule that aligns with your natural productivity patterns and personal needs. An independent business owner is someone who establishes and manages a successful business or company with the aim of expanding it in the future. Running an independent business allows you to make your own decisions and have greater control over daily operations. Sometimes, flexible schedules can be entirely free from restrictions, enabling you to work whenever you wish. For example, during tax season, companies actively seek tax consultants, accountants, and tax specialists to assist with their paperwork and tax compliance.

Can I deduct any of my self-employment tax?

Managing travel expenses is an important part of running a business, especially for self-employed individuals who travel for work. There are travel costs that you can claim as tax-deductible business expenses, allowing you to reduce the overall amount you pay. With the freedom of being your own boss comes the responsibility of paying your own taxes. Unlike employees, who generally have their income tax and payroll taxes withheld through their wages, self-employed individuals generally must pay estimated taxes on a quarterly basis.

When do I need to pay my self-employment tax?

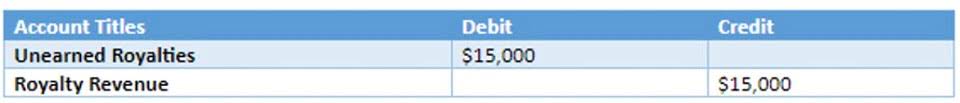

At the same time, success and change can bring on unearned revenue added complexities and taxes are certainly no exception. EY TaxChat™ is here to provide our professional service to assist with filing your individual income tax return. This is an IRA available to self-employed taxpayers that has gained popularity due to ease and increased benefits.

- Additionally, there are special startup tax deductions for expenses incurred while starting your business.

- Compare features, fees, and benefits to find the best payment solution for your needs.

- Self-employment means working for yourself instead of being employed by a specific employer.

- Detailed, well-organized records make it easier to prepare and file tax returns and will help you provide correct answers if your tax return is selected for audit or if you receive an IRS notice.

- These courses cater to different skill levels, providing comprehensive insights into How to Become Self-Employed.

- With the freedom of being your own boss comes the responsibility of paying your own taxes.

Who Needs to Pay

- One of our training experts will be in touch shortly to go overy your training requirements.

- Apps like QuickBooks or Expensify, or even a simple spreadsheet can help you to organize and store your travel expense records easily.

- Success and earnings directly correlate with your effort, expertise, and business acumen rather than preset salary structures.

- You must demonstrate that the convention is directly related to your trade or business, and it is as reasonable to hold the event in the overseas location as it would be to hold it in North America.

- For instance, if someone owes $2,000 in self-employment tax, they can deduct $1,000 on their tax return.

- You usually pay self-employment tax when you file your annual tax return.

This independence allows you to build a business that truly reflects self employment tax your vision and professional standards. Depending on the scale of your venture, you may choose to hire additional staff as you grow. We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Health Insurance Deductions for Self-Employed Individuals

This can comprise costs such as rent or mortgage payments for the portion of your home used exclusively as a home office, as well as business equipment and supplies. As you are not employed by a company that automatically deducts these taxes from your payroll, it is crucial to manage your own income and Self-employment taxes. You can pay these taxes either quarterly or as part of your annual tax return. Seasonal staff provide services to businesses on a short-term basis, typically for no longer than six months each year. They fill roles where demand increases during specific periods or when a position is only temporarily required. This is quite different from the other retirement plan options, with a bit more complexity to establish.

Another significant deduction is the Qualified Business Income Deduction. This allows self-employed individuals to deduct up to 20% of their net income from their business. This can lead to substantial savings, especially for those with higher earnings. Wise has just launched Wise Business, a multi-currency business account that promises to revolutionize the Brazilian market. Compare features, fees, and benefits to find the best payment solution for your needs.

- This tax amount is in addition to your other income taxes assessed on the net income from your business.

- You can keep the receipts from your meal expenses, or alternatively use a standard meal allowance, which varies depending on the travel destination.

- It also calls for self-discipline and the ability to manage time effectively.

- Led by editor-in-chief, Stephanie Johnson, we take great pride in the quality of our content.

- This is an IRA available to self-employed taxpayers that has gained popularity due to ease and increased benefits.

When you’re self-employed, you are responsible for paying your own state and federal taxes. This includes both income tax and a Self-employment tax, which combines Social Security and Medicare. SelfEmployed.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. While we strive to provide a wide range of offers, SelfEmployed does not include information about every financial or credit product Bookstime or service. By understanding these special considerations, high earners can better manage their self-employment taxes and potentially save money.

Understanding how to calculate your self-employment tax is crucial for managing your finances effectively. By using the right forms and knowing the rates, self-employed individuals can ensure they meet their tax obligations without overpaying. Fees for obtaining a business visa or work permit are typically deductible as a travel expense. And the cost of international phone calls, roaming charges, or portable internet devices used for business purposes are eligible for deduction.